College students renting an apartment or dorm room are often unsure why they need renters insurance. Some overlook renters insurance because of misconceptions regarding what it covers, while others underestimate the value of their belongings or think that accidents happen only to others. In fact, there are many reasons to get renters insurance, and the most important is that it protects you and your possessions in situations that could otherwise seriously cost you.

If you are wondering, “Do I need renters insurance as a college student?” the best way to understand the benefits of renters insurance is to be aware of the situations where you may need it and where it can be valuable to you. So, let’s take a look at some scenarios where renters insurance will come to the rescue by providing financial protection should the worst happen.

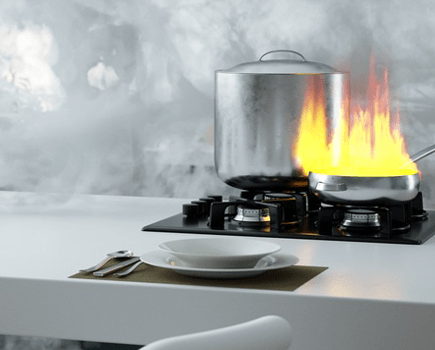

A fire breaks out in your kitchen

Let’s say it’s Saturday evening, and you want to have a quiet dinner at your place. So you start cooking your favorite meal, but all of a sudden, your pan of hot oil catches on fire! You are all right, but the fire damages the stove, cabinets, and counters. Renters insurance can help you with the costs of replacing the things damaged in the fire. And imagine a fire spreads in your apartment, destroying everything, from furniture to electronics to clothing! Again, without renters insurance, replacing all these items at once would be tough.

You leave candles unattended, causing smoke damage

Suppose you want to loosen up after a busy week of studying, attending classes, and participating in extracurricular activities. So you decide to light some scented candles, put some relaxing music on, and finally start reading that new book you bought a few weeks ago. You go to bed all relaxed but forget to blow out the candles. The next thing you know, you wake up to the smoke detector sound! You get out safely, but your place is filled with smoke, and there is damage to the property. Fortunately, renters insurance covers smoke damage.

You leave the sink on, causing a flood

Imagine you are washing the dishes when your phone starts ringing. It’s your best friend in some emergency. You rush out of your place to help your friend. But when you come back, you see that your apartment is flooded because you left the water running! The floor is damaged and needs to be repaired or replaced, and most of your things are soaking wet. Moreover, the water is dripping into your neighbor’s apartment, damaging their stuff too! Luckily for you, renters insurance can cover the damage to the floor, your things, and the neighbor’s items on the floor below you.

A friend gets injured at your party

Picture this: you are throwing a party at your place. All your friends are there and having a great time. One of them goes to the kitchen to get some snacks, but they suddenly slip on a wet floor and hurt their back! Yes, you’ve guessed it, the party is over. Your friend needs medical treatment, so you all head to the emergency room. You will most likely be liable for their injury, but renters insurance can help you by covering medical bills. Furthermore, if they decide to sue you – and they may do this, even if you are friends – renters insurance can also help with legal expenses.

Your dog bites a guest

Let’s say you have a dog. You’ve invited a few classmates for a study session in your room. You are studying hard for that exam next week, but you need to take a small break. One of your fellow students decides to play with your dog. Your furry friend is usually friendly and harmless. But, while they are playing, your dog bites your guest out of the blue! They need some medical attention; in this case, you may also be liable for your guest’s injury. The good thing is that renters insurance covers costs relating to dog bites.

Your gas grill explodes, causing property damage

Suppose you are hosting a cookout in that beautiful backyard of the house you’re renting with roommates. It’s sunny outside, the grilled meat and vegetables are on the table, and everyone is enjoying themselves. However, while you are having fun, your gas grill explodes! Yes, you forgot the close the valve! Luckily, no one was near the grill, but the explosion damaged the outside of your house and part of your neighbor’s property. Renters insurance has your back again since it covers damage caused by an explosion.

Your things are stolen from your place

Let’s say you just got back in your rented home from traveling with your friends during spring break. You step inside only to find your apartment in shambles! You realize that someone broke into your apartment while you were on vacation, and all your valuable items, including your expensive TV, gaming system, and precious jewelry, are gone. Luckily, you were smart enough to get renters insurance before heading to college, and now it will cover the costs of replacing your stolen things.

Someone steals your bike outside

Suppose you are using your bike to get around campus. One day on your way back from the library, you decide to stop at your friend’s place. You lock your bike to the nearest bike rack and enter the building. But, when you come back outside, your bike is nowhere to be seen! Someone stole your bike, even though you locked it. The good news is that renters insurance covers your things no matter where they are, so it can help you replace that stolen bike.

You spill coffee on your laptop

Picture this: You are writing an essay on your laptop. You are deeply immersed in your project when someone knocks on your door. You get up to answer the door, still thinking about that last sentence you wrote, but you accidentally knock over your cup of coffee and spill it all over your keyboard! The keyboard is not working after that coffee spill, and things aren’t looking good for your laptop’s life. Can renters insurance help you in this situation? Unlike other renters insurance policies, NSSI renters insurance has an option for accidental damage coverage, which can now save the day.

You crack your phone screen

Imagine you’re rushing to class when your phone starts ringing. You take it out of your pocket, but at that moment, you bump into someone, your phone slips from your hand and ends on the ground! You hope its sleek and shiny screen is not shattered, but you’re out of luck. You cannot imagine your life without your precious device, and repairing that cracked screen could cost you a small fortune. But not if you have NSSI renters insurance with accidental damage coverage.

No one expects things like these to happen, but they do. That’s why you should always be prepared for the worst-case scenarios by protecting yourself and your belongings with renters insurance.

And the best thing about renters insurance is that it gives you peace of mind that comes with knowing that you are covered should the unexpected happens, so you don’t have to worry about unexpected expenses and can focus on your education and college life. So don’t risk it – get protected with NSSI renters insurance!

Whether you’re living on campus or studying abroad, NSSI has you covered! From spilling coffee all over your laptop to dropping your smart phone in the parking lot, you’re covered wherever you go.

Whether you’re living on campus or studying abroad, NSSI has you covered! From spilling coffee all over your laptop to dropping your smart phone in the parking lot, you’re covered wherever you go.  Did you know that NSSI covers more than just electronics? We cover everything from clothes to textbooks, even jewelry. So whether you accidentally flushed your great- grandmother’s ring or your roommate ran over that expensive business textbook, we’ve got you covered.

Did you know that NSSI covers more than just electronics? We cover everything from clothes to textbooks, even jewelry. So whether you accidentally flushed your great- grandmother’s ring or your roommate ran over that expensive business textbook, we’ve got you covered. Do accidents seem to follow you wherever you go? Don’t worry, we can help! At NSSI we offer unlimited claims on damages to your personal property. Whether it’s a shattered laptop or a flattened smartphone, we’ve got you covered.

Do accidents seem to follow you wherever you go? Don’t worry, we can help! At NSSI we offer unlimited claims on damages to your personal property. Whether it’s a shattered laptop or a flattened smartphone, we’ve got you covered.  Got a dog that lives to destroy furniture? With coverage from NSSI, you can protect your personal property and enjoy your furry friends too. Our plans includes coverage for accidental pet damage.

Got a dog that lives to destroy furniture? With coverage from NSSI, you can protect your personal property and enjoy your furry friends too. Our plans includes coverage for accidental pet damage.